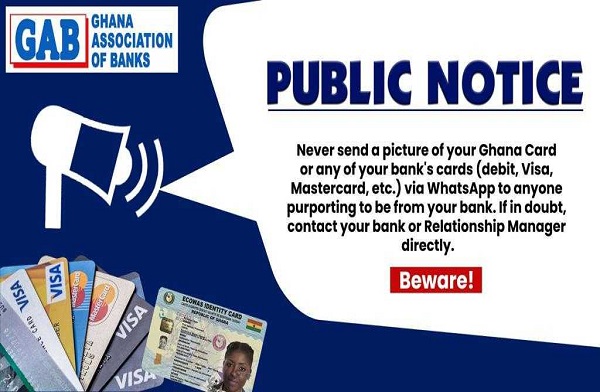

Desist from sharing bank cards, Ghana card on WhatsApp – Association of Banks warns

Advertisement The Ghana Association of Banks (GAB) is warning the general public to refrain from sharing their Ghana card, Visa card, or debit card with individuals who pose as bank staff over digital platforms such as WhatsApp or E-mails. To avoid fraud and scams, bank customers are advised by GAB to abstain from providing images of objects that disclose bank account details and identity numbers. “Never send a picture...