Reduce expenditure, channel resources into savings and cash in on rising interest rates

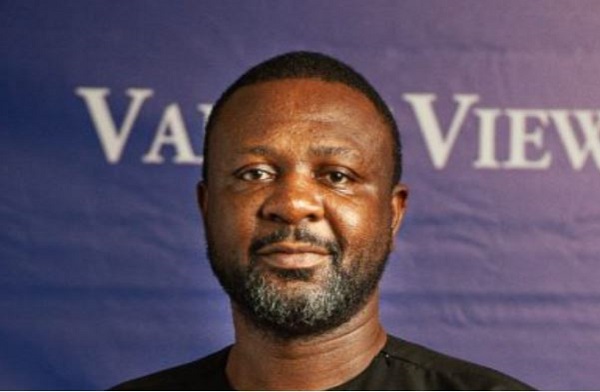

Head of Finance Department at the Valley View University, Dr. Williams Peprah, has urged Ghanaians to take advantage of the rising interest rates to save for the future.

According to him, this is the best time to invest and make money.

Interest rates have surpassed 22% due to the rising inflation, and it’s unclear when it will come down.

Dr. Peprah tells Joy Business, government must ensure the short term instruments have higher yields than the longer term instruments to stimulate savings and investments.

“When things are getting out of hand in terms of pricing going up, it’s time for Ghanaians to reduce their expenditure and rather channel resources into savings. We’ll expect government to make sure that the yield-curve on Treasury bill rates have a higher yield for short- term securities than longer term”.

“Also, this is the time that bond and long term investments become unattractive. When interest rate is going up, there’s an inverse relationship. So the advice is for all Ghanaians interested in being rich to move into savings”, Dr. Peprah pointed out.

He also urged government to intensify its financial literacy programme to encourage many Ghanaians to save for a higher return.

“Government must make sure a lot of adverts are done to make sure Ghanaians move into savings. In fact, if Ghana was to be a productive country, this would have been the time to move into production; but because we are not there yet, we need to move into proper savings”.

Interest rates on the money market are presently going for 22% plus. The 91-day Treasury bill is selling at 22.57%, whilst the 182-day Bill is being quoted at a rate of 24.41%.

Source: Myjoyonline

Leave a Reply