GCB is well-positioned to return value for investors – Kofi Adomakoh

The Managing Director of GCB Bank PLC, Kofi Adomakoh, says the focus of the Bank is driving revenue.

He said having laid a strong foundation and tightening risks, the Bank is well-positioned to return value for investors.

Speaking at an investors’ call last Friday, Mr Adomakoh disclosed that credit underwriting standards have been tightened.

The engagement with investors of the Bank was facilitated by Databank Financial Services Limited and IC Securities (Ghana) Limited

The Management of the Bank used the opportunity to explain the policy and strategic direction of the GCB and its

GCB Bank posted impressive financial results with profit before income tax increasing by 34 per cent in 2021. Growing from ¢602 million in 2020 to ¢810 million last year.

GCB Bank also increased its total asset from ¢15.5 billion in 2020 to ¢18.3 billion in 2021, representing a growth of 18 per cent.

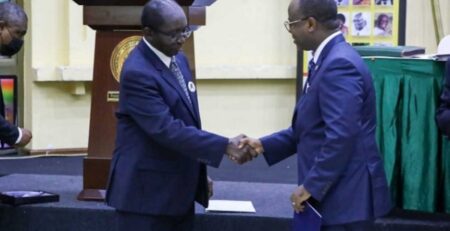

The Management of the Bank had at the end of April 2022 made an appearance at the “Facts Behind the Figures” programme organised by the Ghana Stock Exchange.

Mr Adomakoh explained that the Bank’s strategic ambition is to be the dominant player in the market and the best by every measure anchored around three strategic pillars revenue growth and profitability, operational excellence, people and talents.

The Deputy Managing Director of Finance, GCB Bank, Socrates Afram, explained that an integral part of the Bank’s performance was driven by real growth in its deposit base.

He aid GCB would embark on an aggressive deposit mobilisation drive and that the requisite personnel and other resources have been engaged and procured to achieve this objective.

Mr Afram reiterated that the Bank would work hard to keep costs under control saying, “GCB remains a very solid and sound bank.”

He said the Bank would keep a clean and positive balance sheet and improve customer experience.

The Deputy MD in charge of Operations, Emmanuel Odartey Lamptey, announced that the Bank is making inroads in the mobile money transfer business with the introduction of the G-Money.

Present at the programme included the Executive Director, Wholesale and Investment Banking, Samuel Kwame Aidoo, Executive Head, Retail Banking, John Adamah, Chief Digital and Marketing, Eric Coffie, the Financial Controller, Kwasi Osei Bobie and others.performance.

Source: Myjoyonline

Leave a Reply