Bankers Association calls for increased ATM fraud education

The Ghana Bankers Association has called for increased education on ATM or Card fraud in the country.

The 2020 fraud report from the Central Bank revealed that among other things, ATM or Card fraud accounted for 6.3 per cent of the total number of reported cases, as compared to a proportion of 4.7 per cent recorded in 2019.

Also, ATM or Card fraud recorded a loss value of approximately GH¢ 8.19 million in 2020, as compared to an approximate loss value of GH¢1.26 million recorded in 2019, showing that losses incurred through ATM or Card fraud recorded a 548.1 per cent increase in year-on-year terms.

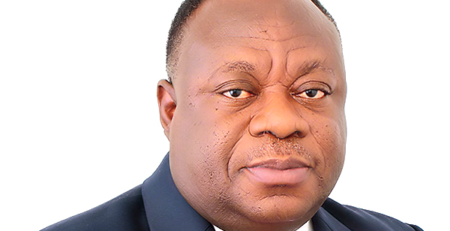

John Awuah, Chief Executive Officer, Ghana Association of Bankers, in an interview Citi Business News in Accra yesterday said, customers of banks needed to take safety of the ATM cards into their own hands.

“We believe that a lot more education and a lot more information to our customers will be appropriate. If you have an ATM card which is linked directly to your bank account, and you are keen to use your card, especially online, you need to know which websites you transact on and the safety mechanisms that have been embedded in those websites,” he said.

Mr Awuah said “If you are not sure, go in for a prepaid card, which is also a debit card. For such a card, you only load the amount of money for the transaction you want to undertake, which limits the potential loss in case a fraudster gets access to your card.”

BoG establishes Financial Industry Security Operating Centre to reduce cyber fraud

Bank of Ghana is seeking to significantly reduce Automated Teller Machine (ATM) and cyber-related fraud with the setting up of a Financial Industry Security Operating Centre, to ensure a safer cyberspace for the banking sector in Ghana.

The assurance follows a rise in the number and value of ATM fraud cases and other types of fraud, as captured in the 2020 banking industry fraud report.

Recently, a 42-year-old man was found to be in possession of 656 ATM cards connected to nine banks operating in Ghana and Nigeria.

The Governor of Bank of Ghana, Dr. Ernest Addison, said the central bank was still investigating the case but said that all 23 banks in the country would by next year be connected to the Financial Industry Security Operating Centre.

Source: Ghanaian Times

Leave a Reply