NIB’s viability under review — BoG

The Bank of Ghana (BoG) is in discussions with the government to assess the viability of a state-owned bank; the National Investment Bank (NIB).

The discussions, which are expected to be concluded by next year, would determine the fate of NIB.

Under the IMF programme, the BoG has committed to completing the remaining tasks from the financial sector cleanup, and these tasks include addressing the insolvency of NIB as well as the long-standing under-capitalisation of several special deposit-taking institutions (SDIs).

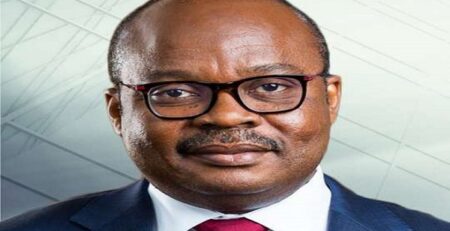

Addressing the media at the Monetary Policy Committee press conference, the Governor of the Bank of Ghana, Dr Ernest Addison, said the issue of NIB and other under-capitalised institutions would obviously form part of the financial sector policy under the IMF programme.

He said once the government was done with the immediate issues of the impact of the Domestic Debt Exchange Programme (DDEP) on banks, it would go back and relook at these institutions and make an assessment on whether they are still viable or not.

“The NIB is one of the banks that we will make that assessment on, to ascertain whether it is still viable or not. If it is viable and the government can find money to recapitalise it, then Yes. But if it is not viable, then, obviously, we will have to find a different use for that instrument.

“These are ongoing discussions between us and the international partners and I believe that in the next year or so, we will get a clearer sense of how to handle those particular institutions that are very weak,” he stated.

Following the completion of the financial sector reforms, all the banks operating in the country successfully recapitalised to GH¢400, except NIB, who are yet to do so.

The NIB, together with four other banks namely ADB Bank, OminiBSIC, UMB Bank and Prudential Bank, were given government guarantee through the Ghana Amalgamated Trust (GAT), which was a special purpose vehicle set up to help these five banks recapitalise.

NIB, however, failed to utilise this opportunity as its liquidity and capital challenges far exceeded what was originally envisaged and have still remained under-capitalised.

With the bank being a state bank, the considerations were different, and, therefore the bank has continued to operate till now, despite not meeting the new minimum capital requirement.

Bank’s first-half performance

Giving an update on the bank’s first-half performance, Dr Addison said the results show considerable growth in profits, following significant losses posted in 2022 on account of the DDEP.

He said if this trend continues, the BoG expects banks to rebuild capital buffers quickly, in addition to equity capital injections by shareholders, to give a further boost to real sector growth and to build resilience in the banking sector.

He noted that the early operationalisation of the Ghana Financial Stability Fund should also help provide additional recapitalisation support for eligible banks in line with the criteria and governance framework agreed with the IMF and the World Bank.

Cost of operations

Governor Addison pointed out that the industry’s cost of operations increased, with operating expenses increasing by 44.9 per cent during the first half, compared with 22.9 per cent growth for the same period in 2022.

He said the net effect of these developments was a 51.2 per cent increase in profit-before-tax in June 2023, compared with 20.8 per cent growth in June 2022.

“The industry’s profit-after-tax stood at GH¢4.3 billion, up from GH¢2.8 billion, and representing a 51.4 per cent increase.

“The strong profitability performance during the first half of the year translated into a higher return-on-equity of 37.6 per cent from 21.9 per cent in June 2022, and a higher return-on-assets of 5.5 per cent compared to 4.6 per cent in June 2022,” he stated.

Source: Daily Graphic

Leave a Reply