Commercial banks support BoG decision to deny Mobile Money loan defaulters access to future credit

Commercial Banks have thrown their weight behind the Bank of Ghana to deny individuals access to future credit for deliberately refusing to register their SIM cards in the ongoing national SIM Card registration exercise, with the intention of dodging loan repayments through their Mobile Money platforms.

The Central Bank in a statement indicated that data of all Mobile Money loan customers are domiciled in the databases of credit bureaus, hence failure to repay such loans will attract “negative repercussions on borrowers’ credit.

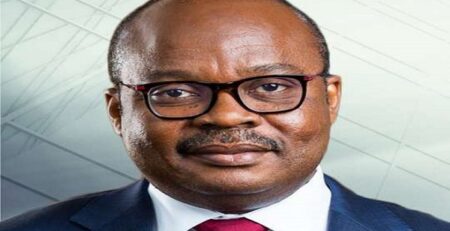

Managing Director of Cal Bank PLC, Philip Owiredu told Joy Business the warning is a step in the right direction.

“I think is a good call from the Central Bank because it’s about time we institute some right credit culture within the economy. We always keep talking about bank credit being high. And one of the reasons underpinning is the level of non-performing loans within the financial service sector”.

“And we see this sipping through to the micro-sector to the extent that we see people taking credit through the MoMo transaction.”

He further lauded the regulator for such a move, adding, “If is a measure that the Central Bank is putting up to enhance the credit culture within the economy, then I think it’s a right call for them to do”.

Source: Myjoyonline

Leave a Reply