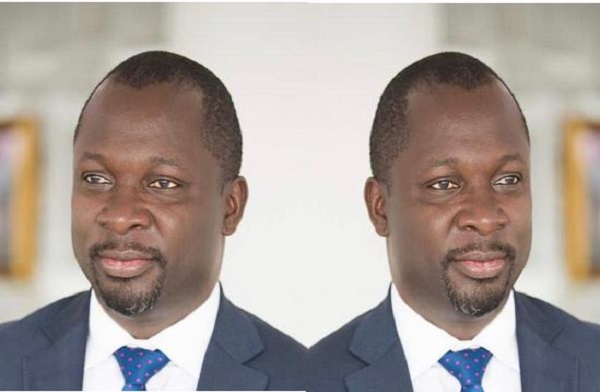

Ecobank Ghana appoints former MD as Board Chairman

Former Managing Director of Ecobank Ghana, Samuel Ashitey Adjei has been appointed Board Chairman of Ecobank Ghana PLC, effective June 11, 2022. He replaces Terence Ronald Darko. Mr. Adjei is an accomplished banker with over 29 years of banking experience, 25 years of which were in executive positions spanning various areas of banking within the Ecobank Group. Mr. Adjei has a proven...