Introducing legislation to force banks to lend is not the way to go – GAB advises

The Ghana Association of Banks has advised against using legislation to force banks to lend to the Agriculture sector.

This comes on the back of recent remarks by the Minister of Food and Agriculture, to the effect that the banking sector has not been lending enough to the country’s agriculture sector to support its transformation.

According to the Bank of Ghana’s May 2022 Monetary Policy Report, at 3.5%, the Agriculture, Forestry and Fishing sectors are the second lowest recipients of credit to the private sector as of April 2022, only faring better than the Mining and Quarrying sector which received 1.8% of credit from banks in the country.

The same report shows that the services sector received the biggest chunk of credit given out by banks at 33.4% a significant jump from 29.4% in April last year.

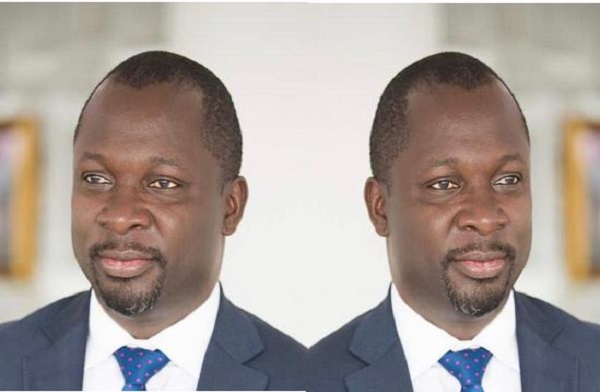

Speaking on the matter of low credit to the Agriculture sector, in an interview with Citi Business News, the CEO of the Ghana Association of Banks, John Awuah, said free market forces should be allowed to determine where the funds of banks go to.

“As much as is possible we want the market to remain the way it is, allowing the forces of demand and supply to determine where the money goes. Yes, we all believe that lending to the Agriculture sector is critical, and as banks, we also take note of that. And GIRSAL’s data will show that banks have actively been partnering them to increase credit to the sector.”

“We are however not so much in favour of legislating lending. In the unlikely event that something negative happens who do you blame? We need to be very cautious,” he added.

Source: Citibusinessnews

Leave a Reply