Reduce expenditure, channel resources into savings and cash in on rising interest rates

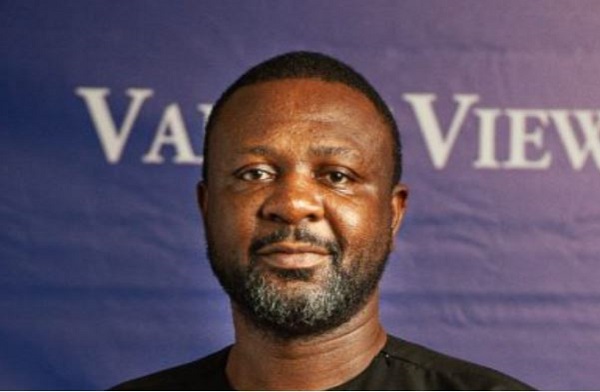

Head of Finance Department at the Valley View University, Dr. Williams Peprah, has urged Ghanaians to take advantage of the rising interest rates to save for the future. According to him, this is the best time to invest and make money. Interest rates have surpassed 22% due to the rising inflation, and it’s unclear when it will come down. Dr. Peprah tells...