Ghana-Nigeria must take bold steps to integrate capital markets—GSE MD

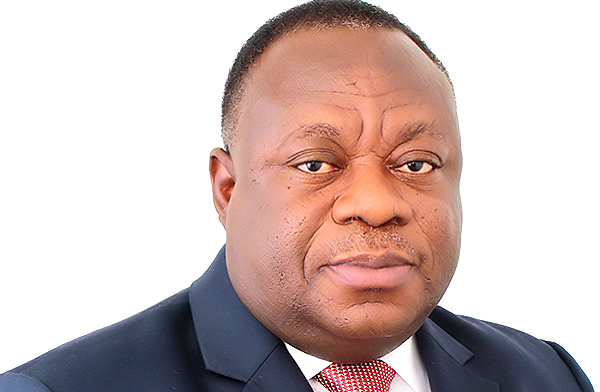

Exchange(GSE), Ekow Afedzie, has strongly urged operators of the capital markets in West Africa, particularly Ghana and Nigeria to complete the process of integration.

The move to integrate the capital markets in the ECOWAS region has been derailed by some Francophone countries, due to differences in market regulations between English speaking countries and the French speaking countries.

But speaking to journalists at Day One of this year’s West Africa Capital Market Conference in Accra, Mr. Afedzie maintained that there is no time to waste any more.

He argued that a bold step by major players like Ghana and Nigeria will send a positive signal to the rest of the countries in the sub-region to also strive to benefit from the gains of the integration.

He stated that Ghana and Nigeria, the two countries with the greatest desire to integrate cannot continue to wait for Francophone countries, to delay the processes.

“I don’t know whether it’s because of their system. They have one currency, one central bank. Don’t forget, they are integrated already and so it might not be their priority. So the way forward is to go ahead with the integration. Ghana and Nigeria can start, and if Ivory Coast gets ready, they join,” he said.

Mr. Afedzie lamented that the processes of integration has always hit a snag anytime the some countries have been indifferent.

“Anytime we get to the stage where certain decisions have to be taken in other to get the integration system rolling, then we have this issues with the francophone countries”.

The West Africa Securities Regulators Association (WASRA) is the regional association for Capital Market Regulators in West Africa with the mandate of facilitating corporation and consultation among Capital Markets in the West African region.

As a flagship programme of WASRA, the conference is a biennial event that seeks to present the West African region and indeed Africa as a whole the opportunity to address important issues related to the orderly growth and development of the regional and continental capital markets.

The conference brought together relevant stakeholders and experts including but not limited to regulatory agencies, market operators, inter-regional economic bodies, and stock exchange managers.

Source: Myjoyonline

Leave a Reply