Ghana has made progress in building cashless society – Archie Hesse

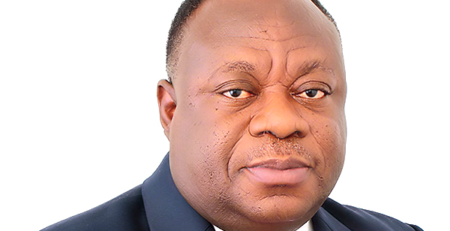

The Chief Executive Officer of the Ghana Interbank Payment and Settlement Systems (GhIPSS), Archie Hesse, believes Ghana is in a position to be recognised as one of the countries at the forefront of being a cashless society.

“If I look at the journey 14 years on, as we speak, we have enough products and services than any other country I know that exists in the world,” Mr. Hesse said during the Citi Business Festival virtual forum on Citi TV.

He said that GhIPSS only needed to make more people more aware of the services and also get the government and the fintechs to embrace and use the platforms fully.

“I believe that when it comes to the infrastructure, we have it. What is needed is for us to create more awareness, look at different use cases, and have entities like our fintech [companies] and government embracing the system and using it.”

“I was reading about the race to become cashless, and there was an article that said Canada is leading, followed by Australia, and then Sweden. And their benchmark was debit cards and credit cards. Now we have them, and we have Mobile Money and so many others,” he also noted.

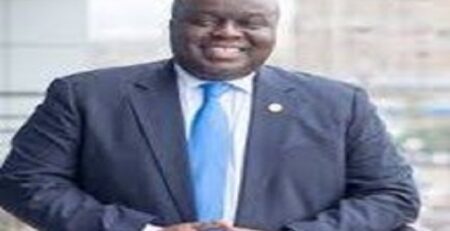

Speaking further about the critical role GhIPSS has played in the fintech space since its inception during the forum, the CEO of IT Consortium, Romeo Bugyei, said it had made it easier to reach all potential customers.

“That central system has taken care of all the things I need to do to be able to serve my customers and with one integration, I am able to hit all the telcos, I am able to hit all the banks, and I am able to push money wherever I want to.”

He added that the centralized infrastructure provided by GhIPSS meant services offered by firms like IT consortium, were “becoming easier than in most countries, especially in Africa, because most of these countries are still running in silos.”

Centralized infrastructure is so important and interoperability is very key to whatever we want to do and achieve. We have issues doing business in Ghana, but what people don’t realize is that doing technology business in terms of Fintechs, I think it’s becoming much easier in this country than in most countries especially in Africa. Most of these countries are still running in silos so when you go there, you can only deal with the Bank or deal with a telco, or have to go through the same process that we went through maybe before the year 2000. And so, when you have a central system that you can pluck into, it makes work so easy and then allows us to think because we are in the business of thinking about new solutions and helping people to use them in the right manner”.

GhIPSS is a wholly-owned subsidiary of the Bank of Ghana which was incorporated in May 2007 with a mandate to implement and manage interoperable payment system infrastructure for banks and non-bank financial institutions in Ghana.

In line with its mandate, GhIPSS has implemented and currently manages the National Switch & Biometric Smart Card Payment System (e-zwich), the Cheque Codeline Clearing (CCC) System, the Ghana Automated Clearing House (GACH) systems- Direct Credit & Direct Debit and the National Switching and Processing System (gh-link).

The first virtual forum of the 2021 Citi Business Festival was on the theme ‘Building a cashless society: Opportunities for business and job creation.

Source: Citibusiness

Leave a Reply