Bankers Association highlights need for citizens to reactivate dormant accounts

The Ghana Association of Bankers has intensified calls by the Bank of Ghana (BoG) to all persons with dormant accounts to reactivate their accounts.

BoG, last month, issued a directive on unclaimed balances and dormant accounts for banks and specialized deposit-taking institutions.

The directive sought to ensure that balances in accounts that have been left unattended to for over a period of time are managed under a special account called a dormant account register.

But the Central Bank in a recent notice tasked all customers of banks who have accounts that have been ignored for more than two years to reactivate their accounts.

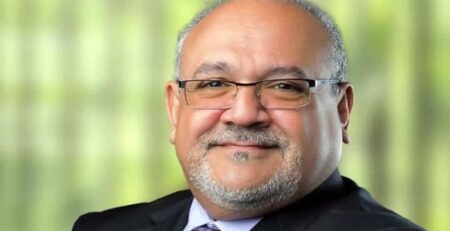

Stressing on this, the CEO of the Ghana Association of Bankers, John Awuah, outlined his outfit’s role in tackling the situation.

“The Bank of Ghana engaged the Association, and we were able to channel our comments on areas that needed further clarity so that there was no ambiguity. So, there is nothing more that banks can do than to enhance the call by the Central Bank. In our reach to the customers, we’ll use whatever medium that we can use to advise our customers whose accounts are falling, or have already fallen into the dormancy criteria category, to take steps to have their accounts reactivated.”

He continued, “Either that or after three years of dormancy, we have a specific job to do to place an advert in the newspapers saying that these accounts have been in dormancy for three years, and by law, we are supposed to ship the balance to the Bank of Ghana. So basically, that what all banks are supposed to do, and it is something that banks were doing in the first place. But now there is more clarity on what the minimum requirements are.”

The directive by the Bank of Ghana which is pursuant to Section 92 of the Banks and Specialised Deposit-Taking Institutions Act, 2016, explained that a dormant account could be a current or savings account with credit balances and their derivatives with no ‘customer-initiated activity’ by the account holder or a third party on the account holder’s behalf for a period of two years.

In the case of fixed deposits or investments scheduled by a customer to roll over upon maturity and the roll-over has persisted for more than three consecutive rollovers or two years, a regulated financial institution shall initiate actions to re-identify the customer, renew consent to continue the instructions and update the customer’s records.

The directive shall however not be applied to accounts that are subjects of litigation, fraud, investigations by a regulatory authority or law enforcement agencies, and others.

Where the regulated financial institution is unable to contact the fixed deposit account holder pursuant to subsection 7, the regulated financial institution shall transfer the funds to the dormant account register.

Read more on the Bank of Ghana’s directive here.

Source: Citibusinessnews

Leave a Reply