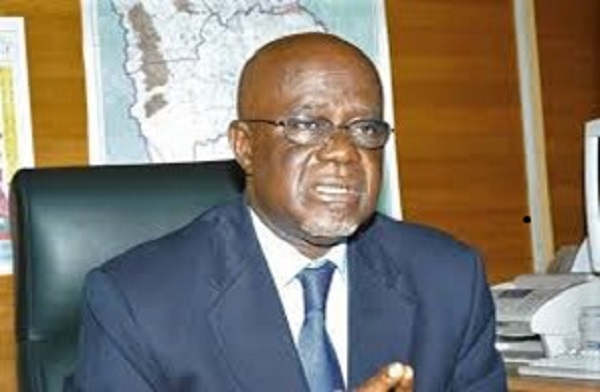

Local banks must fully fund cocoa syndicated loan in future – Hackman Owusu-Agyemang

Board Chairman of COCOBOD, Hackman Owusu-Agyemang, has urged local banks and financial institutions to strategically position themselves, so they are able to fully provide the loan COCOBOD needs to purchase cocoa beans in the not too distant future. Since the 1992/1993 cocoa crop season Ghana’s cocoa sector regulator, has been signing syndicated loan facilities with the participation of a mix...