We remain vigilant to sustain financial stability – BoG

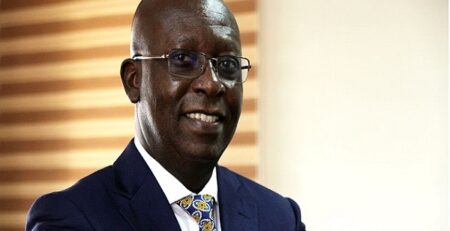

The Bank of Ghana has reiterated its commitment to remain vigilant to sustain the progress made in restoring stability and confidence in the financial sector to forestall a recurrence of such malaise.

According to the First Deputy Governor, Dr. Maxwell Opoku Afari, the reforms undertaken by the Central Bank has restored public confidence and financial sector stability, and as such the regulator will not relent in its efforts to keep the sector safer and stronger.

“On the financial sector, the Bank concluded the two-year comprehensive clean-up and recapitalisation reforms. These reforms have helped restore public confidence in the sector, strengthened financial sector stability and resilience, and promoted ethical banking practices”, he mentioned.

Gains from these reforms Dr. Opoku-Afari stated have begun to reflect in key indicators of the industry including a rebound in credit growth and banks’ profitability.

He touched on the important significance of the year 2020, saying, the year marks the first time fiscal policy management under a rule based regime will be tested in an election year and also from a monetary policy point of view, the first time the memorandum of understanding between the Ministry of Finance and the Bank of Ghana will also be tested in an election year.

“Let me seize this opportunity to assure all that the institutional frameworks that have been put in place to ensure compliance with these arrangements is intact”, said Dr. Opoku Afari.

He thanked the media for its support in all the processes in carefully disseminating the central bank’s policies and outcomes to the public.

According to the November 2019 Banking Sector Report, the performance of the banking industry in the last three months revealed a stronger banking sector has emerged, with improved solvency, liquidity and profitability.

Further, asset quality the report said was improving and banks’ resilience to shocks has been strengthened.

The key financial soundness indicators also remained positive throughout 2019 as banks adhered to sound banking practices following the reforms.

Source: Ghanaweb

Leave a Reply